Drug and Alcohol Treatment Covered by Blue Cross Blue Shield at Acqua Recovery

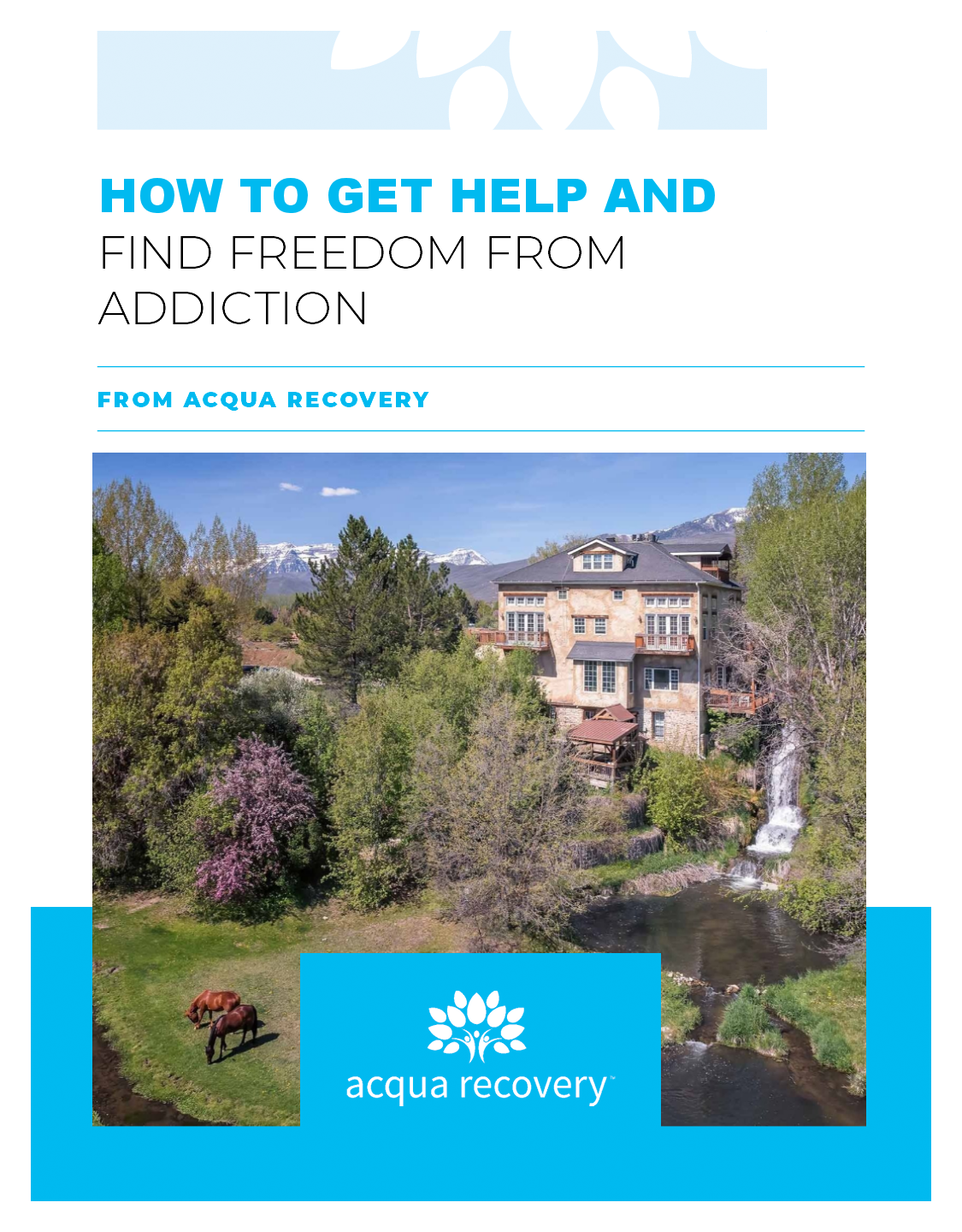

If you or a loved one is struggling with drug or alcohol addiction and have Blue Cross Blue Shield insurance, Acqua Recovery in Midway, Utah may be the perfect place for you to begin your recovery journey. At Acqua Recovery, we believe in a holistic approach to treatment, with a focus on nature immersion and adventure therapy.

Acqua Recovery's Programs and Approach

Our programs are designed to meet the unique needs of each individual, with a focus on healing the mind, body, and spirit.

Our experienced and compassionate team of addiction specialists use evidence-based treatment modalities to help clients achieve lasting recovery. Some of the programs we offer include:

Medical Detoxification: Our medical detox program is designed to help clients safely and comfortably detox from drugs or alcohol under medical supervision.

Inpatient Treatment: Our inpatient treatment program provides 24-hour care and support for clients in a safe and comfortable environment.

Outpatient Treatment: Our outpatient treatment program offers flexibility for clients who need to balance treatment with work, school, or other commitments.

Adventure Therapy: Our adventure therapy program allows clients to connect with nature and themselves through outdoor activities such as hiking, rock climbing, and skiing.

Family Program: Our family program offers education and support for loved ones of those struggling with addiction.

All of our programs are designed to help clients build a foundation for lasting recovery, with a focus on relapse prevention and aftercare planning.

Blue Cross Blue Shield Coverage

At Acqua Recovery, we accept Blue Cross Blue Shield insurance, making our nature-focused approach to addiction treatment accessible to individuals across the country. We encourage you to check your insurance benefits to see what addiction treatment services are covered under your plan. Our admissions team can also help you navigate the insurance verification process and answer any questions you may have about coverage.

Frequently Asked Questions

Q: What types of addiction does Acqua Recovery treat?

A: We offer treatment for alcohol, opiates, cocaine, marijuana, prescription medication addiction, fentanyl, heroin, and meth.

Q: What is adventure therapy?

A: Adventure therapy is a type of experiential therapy that involves outdoor activities such as hiking, rock climbing, and skiing. This type of therapy can help individuals connect with nature and themselves in a deeper way, and can be a powerful tool for addiction recovery.

Q: Is Acqua Recovery an in-network provider for Blue Cross Blue Shield?

A: We encourage you to check with your insurance provider to see if Acqua Recovery is an in-network provider. Our admissions team can also assist you with insurance verification and answer any questions you may have about coverage.

Conclusion

At Acqua Recovery, we believe in the healing power of nature and adventure. Our evidence-based treatment programs, combined with our focus on nature immersion and adventure therapy, create a unique and effective approach to addiction treatment. If you have Blue Cross Blue Shield insurance and are ready to begin your journey to lasting recovery, we encourage you to reach out to us to learn more about our programs and how we can help.

Call or chat with an insurance specialist today.

Dr. Pickrell is a board-certified psychiatrist with interests in addiction and psychiatry. He strives to identify the underlying cause of substance use. His understanding of addiction as the overlapping symptoms of biopsychosocial development is the foundation to his care model. He is committed to helping both patients and families understand that addiction is a treatable medical illness. He has been involved in the treatment of addiction for the last 17 years and completed his residency training at the University of Utah.